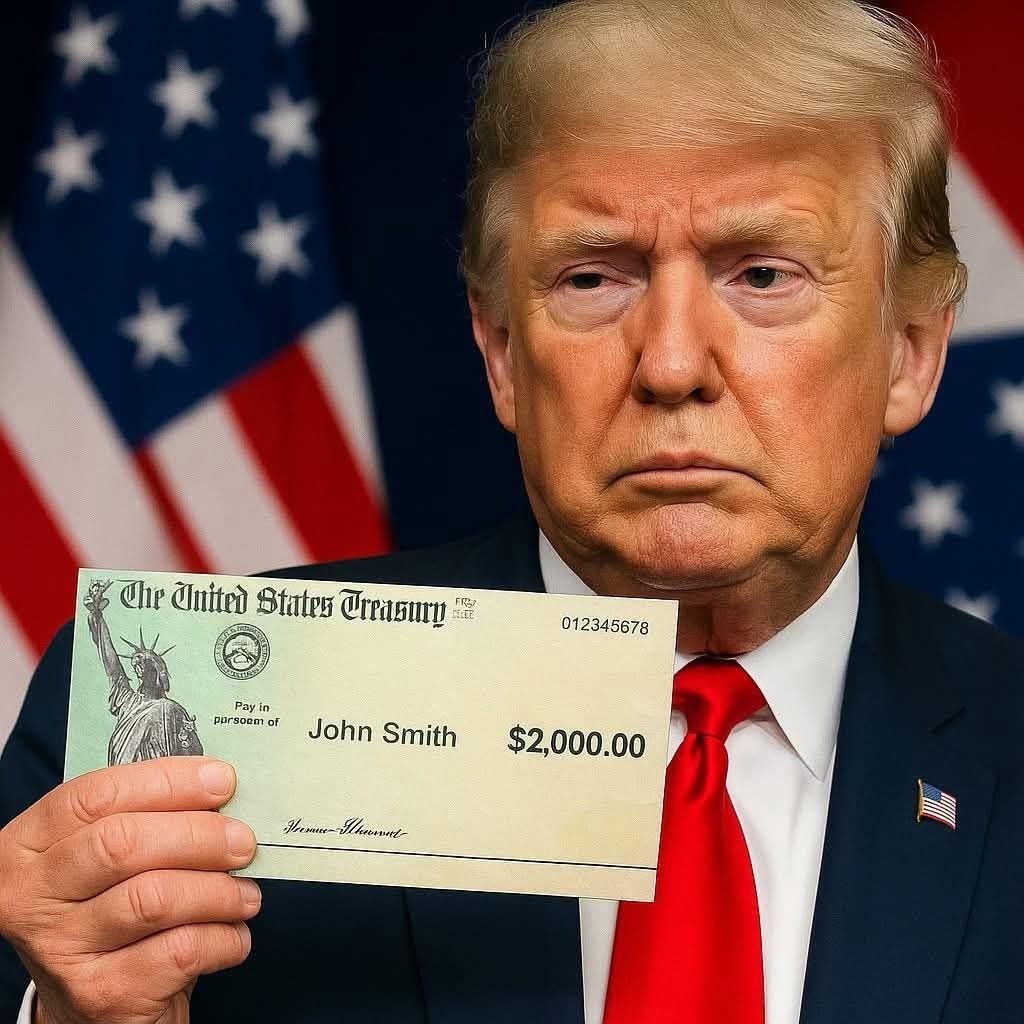

Finally – When payment could occur!

A recent proposal shared on Truth Social sparked widespread discussion across the country. It suggested the idea of providing a nationwide dividend of at least $2,000 per person, funded through tariff revenue. The message described it as a straightforward plan: collect money from tariffs on imported goods and distribute a portion of that revenue directly to households, with high-income earners excluded. No detailed system or timeline was attached, and the announcement came as a broad concept rather than a finalized policy.

The idea immediately drew attention because it touches on something many Americans feel strongly about: taxes, personal finances, and how the government manages revenue. The proposed approach suggests shifting more of the financial burden toward foreign companies that sell goods in the United States, while offering direct benefits to residents in return. Supporters of the concept view it as a way to relieve pressure on everyday taxpayers, while critics question how such a system would function sustainably.

Economists quickly began comparing the concept to the Alaska Permanent Fund, which pays residents a yearly amount based on revenue from state-controlled natural resources. However, Alaska’s system works because it relies on a large, stable source of income. Replicating that model on a national scale using tariffs would require a significant increase in tariff revenue, far beyond what the government currently collects. Any shift of that size would influence import levels, pricing, supply chains, and trade relationships, creating effects that would ripple throughout the economy.

Income taxes currently provide a large share of federal revenue. Replacing them with tariffs alone would require substantial changes to how the economy operates. Higher tariffs could increase revenue, but they could also raise consumer prices and prompt responses from other countries. These possibilities are part of what economists and analysts are weighing as they examine the idea.

While the long-term feasibility remains uncertain, the proposal resonates with many people who feel overwhelmed by the complexity of the tax system. The idea of replacing certain taxes with payments funded by outside sources is appealing to those who feel financially strained. Others remain cautious, concerned about the potential for higher costs on goods, unpredictable revenue streams, or disruptions to federal programs currently funded through taxes.

Many questions remain unanswered. It is unclear whether such a dividend would be issued yearly, monthly, or only under certain conditions. There is no confirmed eligibility system, income threshold, or distribution method. It is also unknown how the government would maintain stability in payments if tariff revenue fluctuated. Large federal programs that rely heavily on tax funds would require new budgeting solutions if income taxes were altered or reduced on a large scale.

Because so many details are still unknown, the proposal exists mainly as an outline. Even so, it has already generated extensive debate. To some, it represents an innovative approach to national revenue. To others, it seems like a plan that faces significant logistical and economic challenges.

For now, it remains an idea under discussion, not an enacted policy. Whether it ever evolves into a detailed plan will depend on future legislative processes, economic analysis, and the broader national conversation. What is clear is that it has brought renewed attention to how the United States collects money, how it spends it, and how different approaches could affect families, businesses, and the wider economy.

In the end, the proposal raises important questions about the future of economic policy and how the government might balance the interests of taxpayers, consumers, and trade relationships. Whether or not the plan moves forward, the conversation it started highlights how deeply financial issues influence public debate—and how strongly people react when new ideas about national revenue and household support enter the spotlight.